Medical Malpractice Insurance

Coverage Overview

MIEC has coverage plans for individuals, groups, and facilities across California, Hawaii, Idaho, and Alaska. Additionally, we offer specialized coverage plans for Acupuncture, Psychiatry, & various physician specializations.

Our policies offer limits of up to $5 million for each claim / $7 million annual aggregate.

The costs of defending you against claims are in addition to these limits i.e. the cost of defending you does not reduce your coverage. Higher limits may be available for individual physicians for physician group entities.

Our policy features

We cover you for allegations of damage or injury resulting either from the delivery, or alleged failure to deliver, health care services to patients. Our policy form also affords you coverage when acting as an independent medical examiner and when providing advice or consultation regarding the health of persons who are not patients. Perhaps most importantly, our policies contain a “consent to settle” clause that means we cannot and will not settle a claim against you without your consent.

Defense Coverage for Specified Practice Risks

- Zero profit motive

- Resolved over 24,000 malpractice suits and claims; nearly 90% closed without payment

- 100% owned and governed by its policyholders

- Rated A- [Excellent] by A.M. Best

- Providing policyholders with continuous service since 1975

- Declared over $446 million in dividend credits since inception

We issued our first policy to an Alaska physician in 1978 and have provided medical malpractice insurance here ever since. We are the largest insurer of physicians and surgeons in Alaska and the only carrier sponsored by the Alaska State Medical Association (ASMA).

We are the West’s oldest doctor-owned professional liability insurance company. Our dedication and integrity, as well as our commitment to tort reform, have earned us the sponsorship of several of California’ most prestigious county medical associations.

We have been providing medical malpractice insurance in the Islands since 1981. We are the largest insurer of physicians and surgeons in Hawaii and the only carrier sponsored by the Hawaii Medical Association. To ensure quick response, we have a local claims office in Honolulu.

We provide medical malpractice insurance to more physicians in Idaho than any other carrier and have provided continuous service since 1977. We enjoy a very close working relationship with the Idaho Medical Association (IMA) and its Medical Executive sits on the Board of our Management Company (MUC). Dr. Ron Dorn of Boise serves on our Board of Governors. In addition, we have maintained a long-standing office for our local claims representative in Boise.

Optional Coverage

Prior Acts (Nose) Coverage

Prior Acts Coverage is available to physicians applying for coverage after being continuously insured by another claims-made insurer, and eliminates the need of purchasing reporting endorsement (tail) from your previous insurer. This coverage is subject to approval by our underwriters.

Miscellaneous Business Liability (optional defense coverage)

We offer at an additional cost, legal defense protection, which pays 90% of reasonable legal expenses, up to $100,000 per civil suit or administrative proceeding, with a maximum of $300,000 for all claims reported during a policy year for the following:

- Breach of contract

- Wrongful termination of an employee

- Employment discrimination or harassment

- Wrongful acts or omissions

- Civil claims for assault, battery, false arrest or personal restraint, malicious prosecution or conspiracy

Premises Liability

We can also provide coverage for premises liability, which insures the liability that arises from bodily injury and property damage to members of the public at your professional office premises. This coverage is optional and it does not constitute comprehensive general, business, automobile liability, or workers compensation coverage.

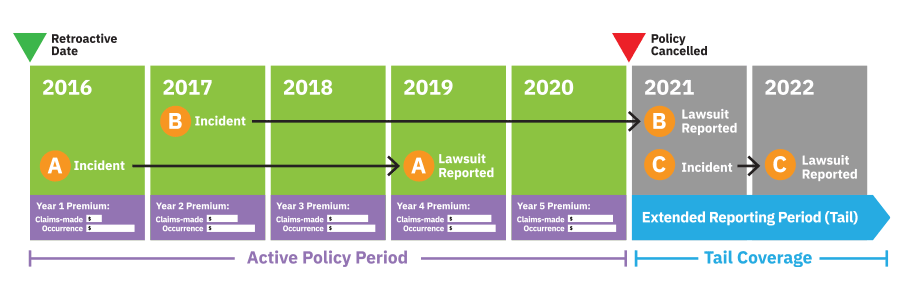

Extended Reporting Endorsement (Tail) Coverage

Offered to any policyholder whose policy is canceled or not renewed, tail coverage extends the reporting time for covered claims beyond the life of the policy. Because most malpractice claims and suits are filed months or years after treatment or surgery, tail coverage is an important safeguard. The premium is based on rates in effect when the coverage is offered. As an MIEC member benefit, policyholders who have been continuously insured with MIEC for at least five consecutive policy years and retire, may qualify for a waiver of tail premium. Tail coverage is also provided at no cost to members in the event of total disability or death.

Claims-Made vs Occurrence Policies FAQ

What happens with a claims-made policy:

What happens with an occurence policy: