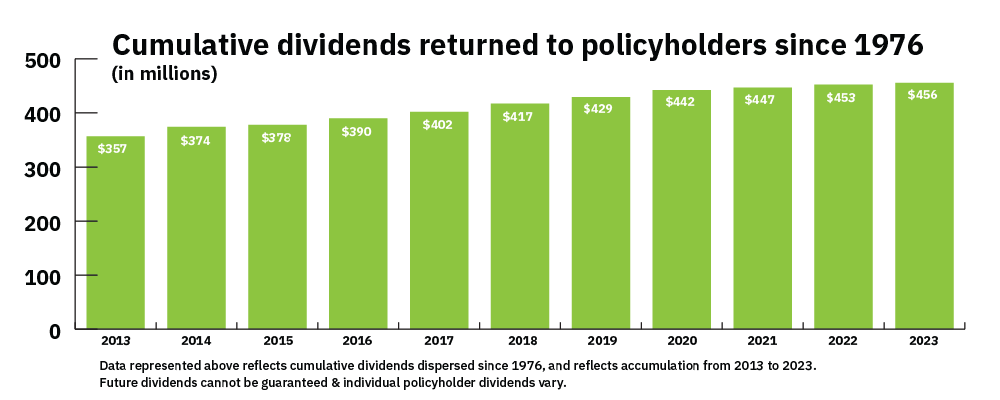

Dividend History

Almost $456 million returned to policyholders

MIEC believes that your money is best kept with you. Therefore, to the extent that we are profitable, we return those profits to our members in the form of dividend credits.

Because we have no external shareholders or owners, we return the proceeds from better-than-expected operating results to our policyholders in the form of dividend credits. Since starting dividend distributions we have declared almost $456 million in dividend credits to our policyholders. Dividends vary yearly and cannot be guaranteed.

How We Determine Dividends

Each state receives a dividend allocation based on its contribution to the results that make the dividend possible. Then, within each state, individual policyholders receive an allocation based on the premium they have contributed during the period. In addition, starting in 2008, a separate dividend is allocated to policyholders whose claims experience is “better than anticipated.” This dividend explicitly recognizes and rewards our policyholders with the best claims experience.

Loyalty and Good Medicine Pay too

We pay more than lip service to loyalty and good medicine—we reward them. Many long-term policyholders receive dividends that reduce their annual cost by 20% or more…sometimes considerably more.

MIEC returns more profit than its competitors

Our philosophy was founded in 1975 by physicians for physicians and it still puts policyholders first. MIEC is not unique in how well it is capitalized but it has proven that it still remembers that it was created to minimize the cost of malpractice insurance. Consequently, when we have excess financial resources we give it back – Immediately – we don’t tie it up in trusts or delayed “retirement benefits”. Philosophy is important. This is proof of MIEC’s philosophy.